Vertical Aerospace has signed a term sheet among the company, its majority shareholder Stephen Fitzpatrick, and its primary creditor Mudrick Capital Management.

This term sheet secures a commitment to $50 million in new funding, strengthening Vertical’s financial position.

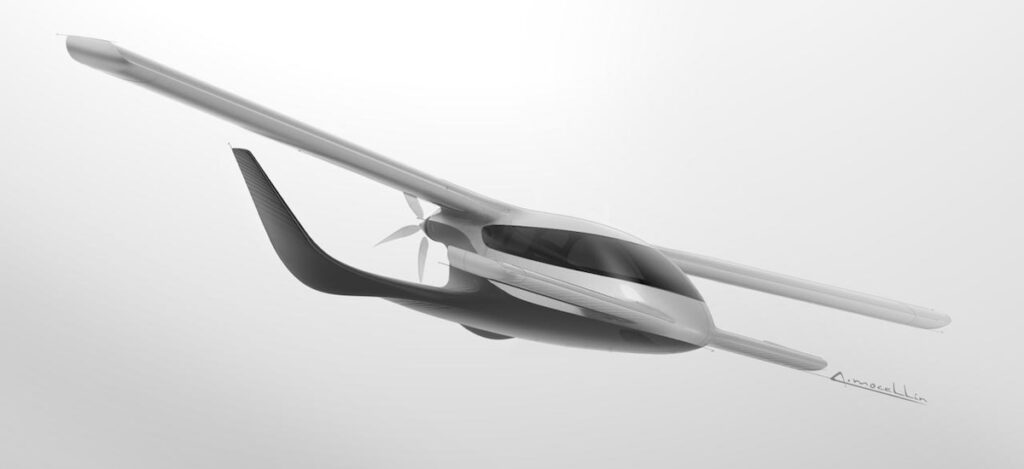

The funding will support the company’s newly launched Flightpath 2030 Strategy to establish itself as a global leader in the eVTOL market by the end of the decade, including the ongoing development and certification of the VX4.

The term sheet includes:

- $50 million funding commitment by Mudrick Capital: commitment includes $25 million in upfront funding, and an additional $25 million backstop that will be reduced by any amounts raised from third parties. The term sheet includes the option for Stephen Fitzpatrick to invest a further $25 million on the same terms.

- Balance sheet strengthening: approximately $130 million of convertible notes (50% of the outstanding amount) will be converted into equity at $2.75 per share, substantially reducing Vertical’s debt and significantly deleveraging the company’s balance sheet, enhancing its financial position.

- Greater certainty for future investors: by fixing the conversion price for the remaining outstanding convertible notes at $3.50 per share, Vertical’s future fundraising plans will be supported.

- Remaining loan repayment date extended to December 2028: extension of term provides further security through Vertical’s certification programme.

- Renewed commitment to the UK: Vertical will continue to operate from its UK headquarters, maintaining its brand identity and focus on innovation.

As part of the agreement, Vertical Aerospace’s founder, Stephen Fitzpatrick, will remain on the board, continuing to provide strategic direction as the company progresses through its certification programme.

Stephen Fitzpatrick, Founder of Vertical Aerospace, said; “It is great to be able to announce this new funding today. We have been working hard to find a way to support the company in the short term, but also set us up for long term success. The additional equity and stronger balance sheet will enable us to fund the next phase of our development programme and deliver on our mission to bring the amazing electric aircraft to the skies.

“This comprehensive deal – alongside the recent piloted flight campaign and launch of the Flightpath 2030 strategy – means Vertical is positioned to be a winner in one of the 21st century’s most exciting technologies.

“The UK has been at the forefront of the aerospace industry for the last hundred years. Aviation is one of the hardest sectors to decarbonise but ambitious British companies like Vertical are leading the world in pioneering zero emissions electric aircraft.”

Jason Mudrick, Founder and Chief Investment Officer at Mudrick Capital, said; “This agreement underscores our appreciation of Vertical Aerospace’s position in the eVTOL sector and a team that has demonstrated its ability to deliver groundbreaking solutions for the future of sustainable aviation. By committing up to $50 million to the business and converting substantial debt into equity, we’re supporting a company, its leadership team and partners, as Vertical brings the safest and most versatile aircraft to market.”

Stuart Simpson, CEO of Vertical Aerospace, added; “This funding agreement underscores the strong confidence of our investors in our Flightpath 2030 Strategy and our ambition to lead the global eVTOL market. By addressing our more immediate capital needs and positioning us well to secure funding for the long-term, we can focus on advancing our piloted flight test programme and bringing the VX4 to market.”