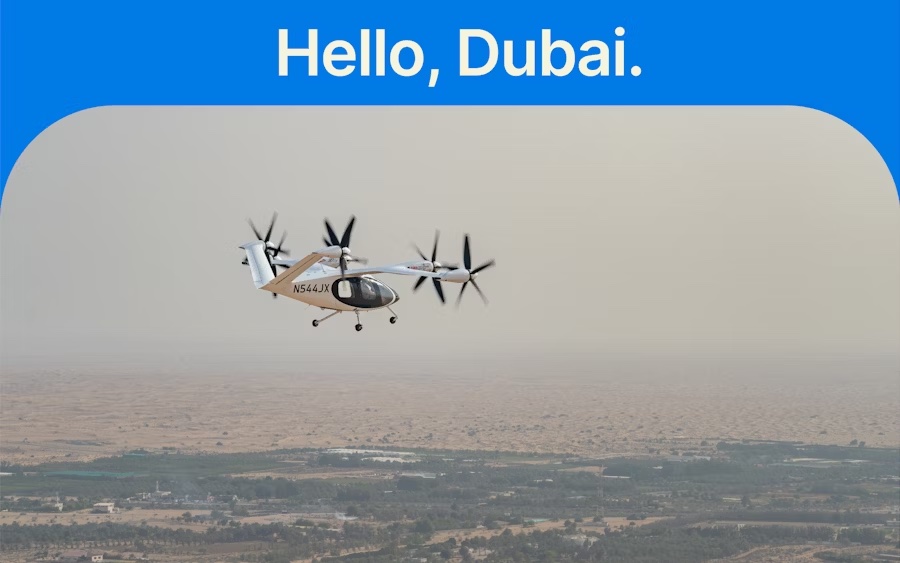

Eve Air Mobility has announced the approval by the executive board of Brazil’s National Development Bank (BNDES) for two credit lines worth $92.5 million to support eVTOL development. The credit lines are expected to offer beneficial terms and conditions to Eve with a 12-year maturity and amortization grace period.

The first credit line is expected to be granted by the Climate Fund (Fundo Nacional Sobre Mudança Climática), a BNDES program designed to provide financing to support businesses and projects that help mitigate climate change and reduce carbon emissions, with urban mobility as one of its nine sub-programs. The second line of credit is expected to be granted by the Innovation Finance (Financiamento a Empreendimentos de Inovação, or FINEM Inovação), a BNDES program that provides long-term funding for disruptive industrial projects that generate social benefits, such as urban mobility, energy generation, education, sewage, among others.

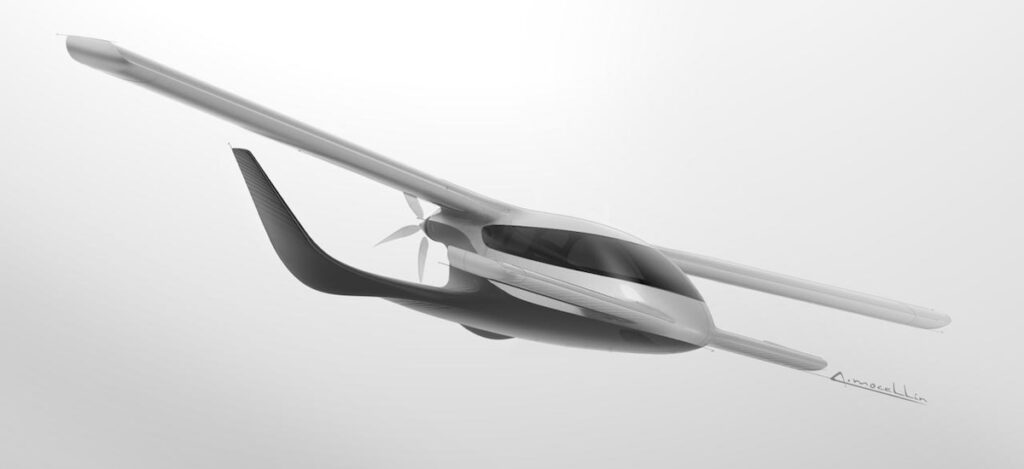

André Stein, co-CEO of Eve, said: “We appreciate the confidence and support that BNDES is showing to Eve as we continue to progress the development of a zero-emission aircraft with a commitment to a full-life cycle approach towards carbon neutrality. Not only will this foster innovation, but will support the emergence of a more sustainable form of aviation, our eVTOL aircraft, which will transform the industry and urban air mobility, reducing noise and the cost of flying. BNDES will be a critical partner to help Eve complete the design of our portfolio of products and services.”

Bruno Aranha, Director of productive and socio-environmental credit at the BNDES, commented: “We are very proud of BNDES’ support for the development of Eve’s eVTOL. This operation is particularly representative in the Climate Fund context, as it involves the development of a disruptive product that will mitigate the emission of greenhouse gases. It is a massive innovative effort carried out in Brazil by highly qualified engineers. The successful development of the eVTOL will allow entry into a highly technologically intensive market segment. It is also worth mentioning that this operation represents another milestone in the long strategic partnership between the BNDES and Embraer, which began in 1997.”

Eduardo Couto, Chief Financial Officer of Eve, added: “The support from BNDES is a perfect fit for our project, considering the characteristics of these lines of credit and the bank’s mission to foster a cleaner form of transportation. These credit lines are expected to have a long-term profile that matches Eve’s cash-flow needs and strengthens our balance sheet. Upon completion of the funding from BNDES, Eve will have a more efficient capital structure – with both debt and equity funding the continued development of our portfolio of solutions for the Urban Air Mobility ecosystem. We believe that a more balanced capital structure is in the best interest of our shareholders and will help create long-term value.”

According to Eve, the financing is subject to the negotiation and execution of definitive agreements with BNDES in connection with such credit lines, as well as the satisfaction of certain conditions to be set forth in such definitive agreements.